Welcome to the Ask Approach Service Spotlight. Each month in 2020 we’ll take an in-depth look at a different service offered by Approach. For a quick look at all of the services available to Approach clients, download our Approach Services infographic.

Refunds for light-duty work

In 2012, Washington state took something that already made good business sense – light-duty work – and turned it into a no-brainer. The Washington Stay-at-Work (SAW) program rewards employers who bring their injured employees back to light-duty work with incentives up to $13,900. This program is available to any company with employees in Washington state, but Approach has a full-time specialist dedicated to helping our employers earn the highest-possible rebates.

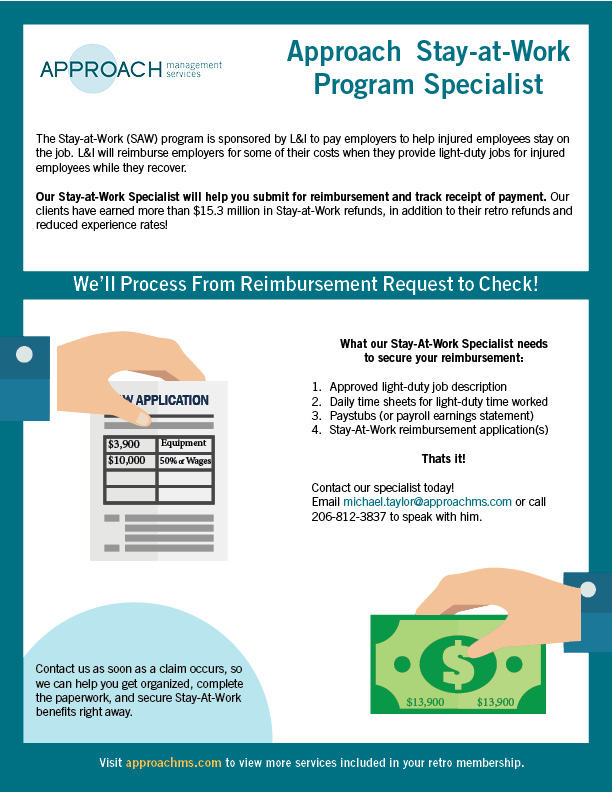

Put simply, SAW will reimburse half of the employee’s wages, up to $10,000 or 66 days of light-duty work, plus $3,900 for related expenses. Many companies don’t have light-duty work at the ready, so Approach uses a 3-point plan to help workers back on the job.

Contact us as soon as an accident occurs or a claim is filed, so we can provide:

- 1-on-1 support to guide you through the process

- Free templates for light-duty job descriptions and offer letters

- Continued support with doctor approval and the overall claim process

This last point is critical because Stay-At-Work applications can and will be rejected for failing to submit the job description for doctor’s approval. You must keep a record of the date that the job description was transmitted or hand delivered to the doctor. This date is the first one for which you can claim SAW refunds.

Tip: As long as the light-duty work is within any work restrictions outlined on the Activity Prescription Form (APF), Stay-At-Work reimbursements can start from the day you request approval. You don’t have to wait to hear back from the doctor!

How to claim Washington Stay-at-Work reimbursements

Our Stay-at-Work specialist says the biggest surprise for employers about the Washington Stay-at-Work program is that it really does work! And, many employers are getting the maximum $10,000 benefit, especially in higher wage industries like electrical and HVAC.

We’ll need good records to help you claim your full entitlement, so be sure to keep:

- Time cards, which must show the date and the number of light duty hours worked (Sample time card)

- Pay stubs (or payroll earning statements), which need to show the gross pay received while on light-duty (Sample payroll earning statement)

Our specialist will want all of the records for every day of the light-duty assignment, even if it lasts longer than 66 calendar days. That’s because he can help you to select the days with the most hours worked, thereby increasing your potential rebate. This can also help if some days you submit don’t qualify, such as sick or vacation days or time off for medical appointments. Wage rebates can only be given for actual work performed while on a light-duty assignment.

What is the Washington Stay-at-Work Equipment Rebate?

Our Stay-at-Work specialist won’t stop with your wage rebates. Indeed, there’s nearly $4,000 available for each light-duty assignment to cover the cost of training and equipment. These don’t need to be medical or adaptive in nature — just something that your employee will need in order to make the light-duty position work out.

According to our Stay-at-Work specialist, “the equipment needs to be necessary for your employee to return to work, so something that’s purchased weeks into the assignment won’t pass that test.” In other words, any equipment you plan to claim for reimbursement must be purchased when the worker signed the light-duty offer.

If your field employee needs a desk and computer in order to be in the office, these can qualify, along with business casual clothing to help them look the part. Your retro coordinator and our Stay-at-Work specialist can help you plan upfront, so that you can purchase the necessary equipment and have an understanding of what’s likely to be reimbursed through the Stay-at-Work program.

Tip: Any equipment you plan to claim for reimbursement must be purchased when the worker signed the light-duty offer.